Opportunities with Pocket Option

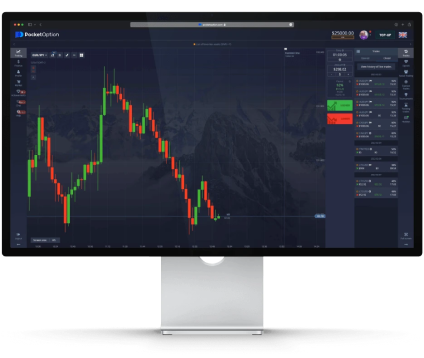

Flexible trading

Latest trends: quick and digital trading, express trades, mt5 forex, pending orders, trades copying. Payouts up to 218%

Comprehensive education

Pocket Option Pakistan help section contains tutorials, guides and various trading strategies.

Diverse trading instruments

Trading Pocket Option offers assets suitable for any trader: currency, commodities, stocks, cryptocurrencies.

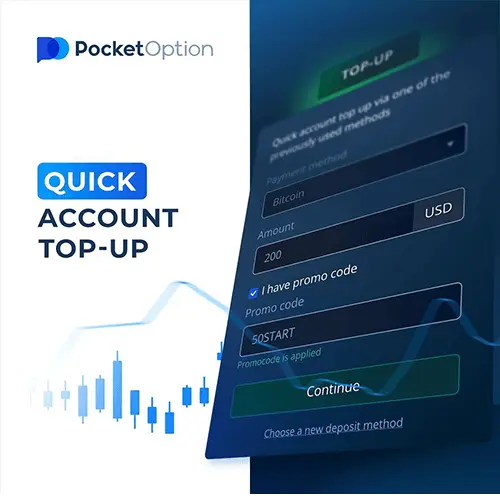

Attention, traders in Pakistan! Join the platform now, verify your account, and deposit to unlock a 50% bonus. Elevate your trading efficiency and diversify your strategies. Don’t miss this opportunity. Register Now!

What is Pocket Option

In the year 2018, Pocket Option achieved a remarkable milestone, surpassing one million users. As of now, the number of registered users has skyrocketed, eclipsing an astounding 10 million individuals and counting.

Pocket Option operates as part of Infinite Trade LLC. Infinite Trade LLC is registered in the Republic of Costa Rica, San Jose – San Jose Mata Redonda, Neighbourhood Las Vegas, Blue Building Diagonal To La Salle High School with registration number 4062001303240.

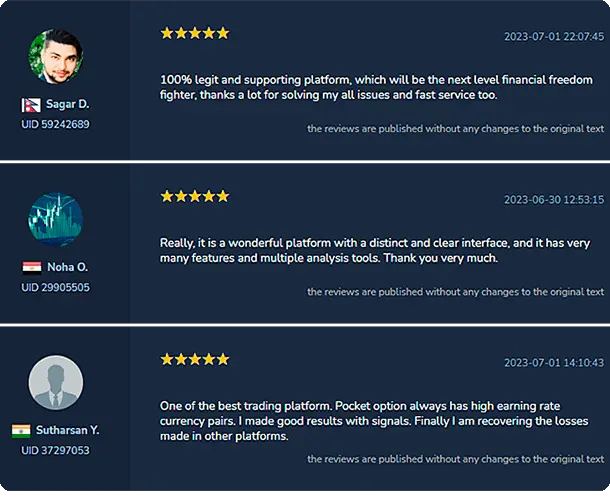

Trusted and Acclaimed Trading Platform

– Leading the charts as one of the most user-friendly brokers according to customer reviews.

– A thriving community of traders and influential bloggers sharing valuable trading experiences and strategies.

– Trusted reputation as a hub for knowledge exchange, collaboration, and support.

– Recognized for its commitment to customer satisfaction and excellence in the trading industry.

Join our community today and start trading!

Data and Funds Security

Protection for trading:

– Cancel losing trades: Purchase risk-free options on the Market and cancel losing trades to recover invested funds.

– Utilize the Rollover feature: Extend the duration of open orders to increase profits and minimize potential losses.

– Stop-loss and take-profit options: Guaranteed execution of trading orders.

Trade Anytime, Anywhere

– No additional commissions

– Wide selection of trading instruments

– Automatic order execution

– Customizable trading terminal

– Maximum number of trading indicators for analysis

– 24/7 access to over-the-counter assets

– Access deposits via web interface (PC/mobile)

– Dedicated smartphone applications, such as Pocket Broker

– Regular trader competitions and bonuses

– Free signals

The platform follows all the modern trends in the field of financial market trading. By actively incorporating user insights, Pocket Option continually enhances its online platform to meet the evolving needs of traders.

Easy Deposit and Withdrawal in Multiple Ways

Credit/Debit Cards: Conveniently fund your account using major credit/debit card providers such as Visa, Mastercard, and Maestro.

E-Wallets: Utilize popular e-wallet services like Skrill, Neteller, and WebMoney for quick and secure transactions.

Cryptocurrencies: Embrace the future of finance with cryptocurrency payments.

Bank Transfers: Seamlessly transfer funds from your bank account to Pocket Option using traditional bank transfer methods.

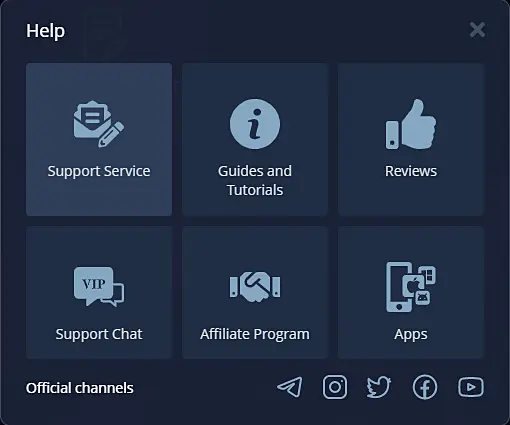

Support is Available 24/7

Traders can also benefit from a special chat feature for quick responses from fellow traders.

For further assistance, contact the support team via phone at +44 20 8123 4499 (10:00-02:00 UTC+2) or email at [email protected].

There is also a large section with guidance and answers to the most common questions.

Start trading with Pocket Option

– Create a free trading account with your email or authorize via Facebook or Google.

– Enter your personal information in the profile and upload ID and address documents.

– Add funds to your trading account balance by using the most comfortable deposit method.

– Choose a trading asset, set up a preferred chart layout and enable indicators for better market analysis.

Pocket Options is:

100+

assets

The platform offers all the range of instruments for trading.

$0

fee

Pocket Option charges no commission on deposit and withdrawal

50+

payment methods

The traders are welcome to use any deposit method of their preference from a really long list.

What is Pocket Option?

Pakistan Pocket Option is a platform that supports binary options trading. It is an unregulated broker that focuses on professional traders who already have a good trading skills and an understanding of the space and how the binary options market works.

Note: We have noticed that some of our visitors might reach us by searching for Poket Option. While the correct name is Pocket Option, we value every visitor and strive to provide the best information and support.

Is Pocket Option available in Pakistan?

Pocket Option is available in Pakistan. It is the number one broker in the list of best 5 binary options brokers in Pakistan.

How to use Pocket Option?

Pocket Option trading allows clients to earn additional income trading on Forex and binary options independently or copying the deals of other successful traders from all over the world. The broker gives traders access to a social trading platform, enabling investors to earn passive income without thorough market analysis.

Does Pocket Option have commissions and fees?

Pocket Option is a great choice because its users don’t pay a commission on deposits or withdrawals. So, there are no hidden trading fees to deposit money to replenish your account or when withdrawing funds from it.

Where is Pocket Option headquarters located?

The company is registered in and has its headquarters office in the Marshall Islands, where it is regulated by the International Financial Market Relations Regulation Centre (IFMRRC).

Note: We have noticed that some of our clients occasionally search for us using the spelling Poket Option. We want to clarify that the correct name of our brand is Pocket Option. However, we value every client, even if they accidentally made a typo in their search.